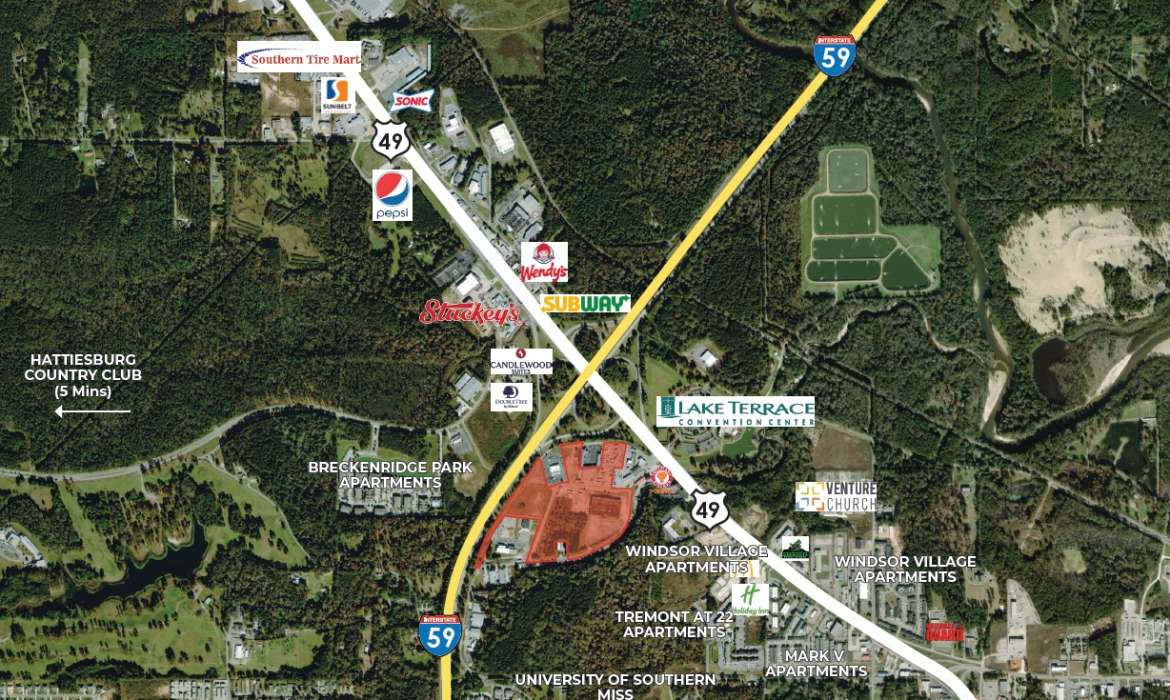

Overview

- Total Size: +/- 28 Acres

- Development parcels from 1 acre and up available

- 48,000 average daily traffic on Interstate 59 & 29,000 average daily traffic on Highway 49

- Visibility from I-59 and Hwy 49

- Directly across from the Lake Terrace Convention Center

- Population within 15 minutes: 78,396

- Households within 15 minutes: 31,662

- Average Household Income within 15 minutes: $68,606

Possible Incentives

Tax Increment Financing District

Tax Increment Financing (TIF) is a public financing method used by municipalities to subsidize redevelopment, infrastructure, and other community improvement projects through future gains in tax revenues. TIF uses the increase in property tax revenues that result from an area›s redevelopment to fund the costs of that redevelopment. The expected increase in tax revenue, which is the increment, is used to finance bonds issued to pay for the project›s initial costs.

SMPDD Commercial Redevelopment Program

The Redevelopment Program, under the authority of Miss. Code Ann. § 1-19-17, enables private developers and property owners to apply for a redevelopment tax reimbursement. This initiative encourages the reuse and revitalization of vacant commercial buildings or designated redevelopment areas. Interested parties must submit an application to the Southern Mississippi Planning and Development District (SMPDD) for project validation under the Revitalization Program.

This program supports improvements to both the exterior and interior of private buildings, aiming to enhance the appearance and functionality of blighted or vacant commercial properties. In Hattiesburg, certain areas are designated for this program, qualifying for a tax rebate of %35. The maximum rebate offered is one-third of the total project cost, which can be claimed over a -15year term. Rebate payments are made to the developer or property owner in predetermined amounts starting after the first year of redevelopment and the opening of new commercial tenants.

New Market Tax Credit Program

The NMTC Program attracts investment capital to low-income communities by permitting individual and corporate investors to receive a tax credit against their Federal income tax return in exchange for making equity investments in specialized financial institutions called Community Development Entities (CDEs). The credit totals 39 percent of the original investment amount and is claimed over a period of seven years (five percent for each of the first three years, and six percent for each of the remaining four years). The investment in the CDE cannot be redeemed before the end of the seven-year period. The program allows certain qualified Community Development Entities

(CDEs) to compete for a certain allocation of tax credit amounts, which flow to investors who make Qualified Equity Investments (QEIs), in certain Qualified Low-Income Community Investments (QLICIs), administered by the CDEs. This site is in a severely distressed area.